Auto insurance can protect you from the financial costs of an accident including vehicle repairs or medical expenses due to injury from a collision, provided you have the proper coverage. Yet many people are unclear about what their insurance policy covers until it is too late. They may have difficulties settling a claim or face rate increases or termination of coverage.

Liability vs. full coverage

The difference between liability and full coverage is straightforward. Liability insures against the damage you could cause other people or their property while on the road. Full coverage applies to damage to your vehicle.

What is full coverage?

Despite the name, full coverage doesn't cover everything. Generally, full coverage will cover the cost of damage to your vehicle.

Full coverage comprises two additional types of coverage: Collision and Comprehensive insurance. Collision insurance is generally for damage from situations when you are driving. This means things like a collision with another car, driving off the road, or hitting an object.

Comprehensive covers damage to the vehicle outside of driving situations, so for example, weather damage, fire or theft.

Several factors determine your auto insurance rates. For example, an older, more experienced driver will have a lower rate than an inexperienced driver. A number of things affect the premiums you pay for auto insurance, factors that could lower or raise your insurance rates include:

- Gender

- Age (teen drivers and drivers under 25 have higher rates)

- Marital status (Married drivers are viewed as more responsible)

- Driving and claims record

- How vehicle is used

- Anti-theft systems

- Amount of coverage

- Amount of deductible

- Credit history

- Miles driven each year.

- Number of drivers on policy

- Car's make, model, year of vehicle

- City and neighborhood (African-Americans neighborhoods charged higher premiums)

- Longtime customers

- Multiple-car discount

- Multiple policies with same company such as renters or homeowners insurance

Helpful Tips When Shopping For Insurance

- Find a reliable company. Contact the Department of Insurance to find out if a company is licensed in Missouri. Check a company’s complaint record. Check a company’s financial stability to ensure that it can pay its claims.

- Find a reliable agent. Some companies sell through local agents and some through direct marketing or group plans. If you wish to buy insurance from an agent, look in the yellow pages, online or ask people you know and respect for their recommendations. Look for a licensed agent (insurance producer) who is reliable and helpful in answering any of your questions.

- Shop carefully. Insurance is expensive. You should shop around for the best product at the best price. The key to comparison-shopping is to determine what coverage you need, how much of you need and what it will cost. Obtain more than one estimate or quote. Do not be rushed into buying a policy by high-pressure sales tactics. Do not be misled by advertising or buy a policy simply because it is endorsed on television, radio, in newspapers or other advertisements by famous people.

- Understand what you are buying. Ask for a detailed explanation in layman’s terms (glossary of insurance terms). Don’t accept calculations or examples you don’t understand. Remember, if it sounds too good to be true, it probably is.

- Fill out your application completely and accurately. It is important to give correct and complete answers when applying for insurance. If you omit or misrepresent information, the company can void the contract.

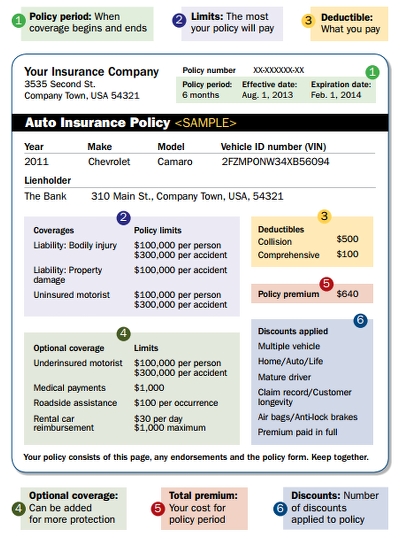

Understanding your declarations page

Be sure to read the declarations page of your auto insurance policy. This summary includes your policy’s important details: the duration of coverage, annual premium, the maximum amount your insurance company will pay out for each type of claim, and how your premium payment is split between each part of your coverage.

To file or not to file a claim

Filing a claim may increase your insurance premiums, even if you don’t collect anything. If you are in a one-car accident with no injuries or damage to other cars or property – and the damage to your car is about the same as your collision deductible – you may consider paying for the repairs yourself to avoid higher premiums in the future. However if another driver or someone else’s property is involved, or if you have a passenger, you should immediately notify your insurance company to protect yourself in case the other party files an insurance claim or lawsuit.

Financial Strength

Some companies are run better and more efficiently than others. It's not uncommon anymore to hear about a major company filing for bankruptcy or going out of business. If your insurance company can't afford to pay claims, your policy is worthless, so you should verify that the insurance company you choose is financially sound.

A good place to start your research is Insure.com which provides insurance company ratings. Insure.com provide an overall score, that weighs insurance companies' customer service, claims, price, recommendations, renewals and financial strength to provide an overall score or ranking. If you're purchasing a car, Insure.com can also tell you which vehicles are the most or least expensive to insure.

You might want to also take a look at the A.M. Best and Standard & Poor's ratings. Both companies publish financial strength ratings for all insurance companies — these "measure" an insurance company's ability to pay out a claim (they have nothing to do with the way a company treats its customers). It is important to understand that if your insurance company will not, or cannot pay a claim, you will be held responsible for payment.

Things to consider when shopping for auto insurance

See what type of insurance policies are offered by the company. If you know what kind of policy you want, check to see if an auto insurance company provides that policy or not. Read up on which claims are entertained by the company. You might decide you don't need collision coverage because your car is old and would be cheap to replace, but you do need personal injury insurance because you can't afford to take time off work.

- Check what insurance is required by your state. Not all states require liability insurance, for instance.

- If you have an unusual car, such as a historic vehicle, look up companies that will offer you a policy specific to your needs.

Compare reliability. The company you choose should have a good reputation for settling claims. Read online to assess the reputation of each company. Check out the time taken by the company to process the claims and pay them off. You can also check your state insurance department's website to find out about the company you are interested in.

- Contact local body shops and ask what insurers they recommend. Workers in body shops witness customers dealing with insurance companies all the time and know which ones are the most reliable

Check your available connections for resources. Consider combining your insurance. If you have home insurance, call the company that provides it and ask if you are eligible for a discount if you get your car insurance from them. Check with your employer to see if they have a connection to an insurance company, and can get you a better rate.

- If you already have car insurance, and you have a good record with them, call them and ask for a renewal discount. This can significantly lower your premium, and save you the hassle of changing companies.

Check each company for discounts. Companies lower your rates based on occupation, driving history, gender, age, and other factors. Ask each company what discounts are available for you. Check for student discounts, military discounts, low-risk occupation discounts. Ask for safe driver discounts if you have not been involved in an accident for at least a year.

- Some insurance companies offer discounts for student drivers with high GPAs.

- Do you belong to AAA or another auto safety club? That might qualify you for a discount.

- The features of your car might lower your rates. If you have antilock brakes, automatic seatbelts, or airbags, check to see if this can lower your premium.

Check for complaints. When checking for an auto insurance company, pay attention to its complaint ratio. Check your state's Department of Insurance website, where the customer complaint ratio of each company is listed. This shows the number of complaints received by the company versus the number of complaints settled by them. Higher ratios mean an unreliable company.

Call or meet with company representatives. Gauge the level of customer service available by meeting with or calling customer service representatives. Check to see that they are friendly, prompt, and informed. Ask the hard questions, and make sure they are able to answer you. If a company is slow to answer and if the representatives don't answer your questions, move on.

Get quotes from multiple companies. When you look for auto insurance, you should compare the rates and reliability of at least 5 different companies. If you don't compare, you could end up paying almost twice as much to insure your vehicle. Once you have determined the companies that seem most stable, get quotes from them all to see what you can best afford.

Check baseline rates. Start by checking the basic car insurance price quoted by the company's website. This number can change dramatically as other costs are considered, so don't stop here.

Check liability coverage. Check to see how much liability coverage each insurance company is offering in relation to the overall cost of insurance premiums per year. This amount can vary quite a lot between policies. Add this number to your basic rate.

Consider deductibles. Paying the lowest deductible may be tempting, but it might land you with a lot of expenses if you get in an accident. If you get in an accident, you will have to pay the amount of the deductible before your company pays anything.

Get information on accident forgiveness. If you are involved in an accident, some companies will raise your rates significantly. Call a representative and ask what effects an accident, or multiple accidents, would have on your insurance. Eliminate companies that raise rates unreasonable after an accident.

Types of Auto Insurance

Every state requires drivers to carry minimum levels of auto insurance coverage or the equivalent in financial responsibility waivers. These requirements ensure that you can pay for property damages or medical expenses. There are several components that can make up your insurance policy:

- Liability coverage protects you if you are at fault for a collision. It pays for medical expenses and vehicle damage for the other driver and passengers. (Liability insurance does not cover repairs to your vehicle)

- Uninsured motorist coverage pays for damages to your car and medical expenses if an uninsured driver hits your car.

- Collision coverage pays to repair your vehicle if you were at fault for the collision.

- Underinsured motorist coverage pays damages for your car if someone hits it, but doesn’t have enough insurance to cover your medical expenses and car damages.

- Medical payments cover medical care up to specified limits for you and your passengers.

- Comprehensive coverage pays for damages to your car due to theft, vandalism, hail, flood, fire, animals, or falling objects.

- Additional coverage includes rental reimbursement, which pays for a rental while your car is being repaired. You may not need to buy insurance from the car rental company. Check your policy to see if it covers rental cars. Roadside assistance. Aftermarket installations, such as stereos and wheels, may need additional coverage.

Force-placed coverage

If you finance or lease a vehicle and haven’t bought collision and comprehensive coverage, your lender or lessor may “force place” collision and comprehensive insurance coverage to protect its investment in the car. Although they place it, you still pay the premiums. And it probably will be more expensive than if you had bought it on your own.

Cancellation of Policy

State law allows your insurance company to cancel your policy for any reason during the first 60 days. After the first 60 days, the policy must stay in effect for the full term, except for:

- Non-payment of premium.

- Suspension or revocation of your driver’s license.

Your insurance company may decide not to renew your policy when it expires. You must be notified in writing at least 30 days before the expiration date.

Missouri Motor Vehicle Insurance Requirements (Financial Responsibility)

Missouri law (Section 303.160, RSMo) requires that all motor vehicle drivers and owners maintain some type of motor vehicle liability insurance coverage. Unfortunately, each year thousands of Missouri citizens are involved in automobile accidents with drivers who have not maintained the required automobile insurance. This results in unpaid damage claims and higher insurance premium rates for all Missourians.

Missouri motor vehicle owners are required to show proof of insurance when registering a vehicle and renewing their license plates. Liability insurance covers your legal liability when injuries or property damage happen as a result of your actions. The minimum level of coverage required by state law is:

- $25,000 per person for bodily injury

- $50,000 per accident for bodily injury

- $10,000 per accident for property

The law also requires you to have uninsured motorist coverage of $25,000 for bodily injury per person and $50,000 for bodily injury per accident.

Nonresidents must maintain insurance that conforms to the requirements of the laws of their state.

You must keep some proof of insurance in your vehicle at all times. If a law enforcement officer asks for proof of insurance and you cannot show it, the officer may issue you a ticket. Three things may occur for failing to show proof of insurance:

- The court will send the conviction to the Driver License Bureau. The conviction will be entered on the driver’s driving record and four points will be assessed. It only takes a total of eight points within an 18-month period to lose your driving privilege in Missouri.

- The court may enter an order of supervision. This order is sent to the Driver License Bureau so that the driver can be monitored to ensure automobile liability insurance is being maintained.

- The court may enter an order suspending the driver’s driver license for failing to show proof of insurance. This order is sent to the Driver License Bureau at which time the driver is notified of the suspension of his or her driver license.

The Department of Revenue will be notified that you do NOT have insurance on your vehicle or the vehicle you drive if you are in an accident or a police officer asks you to show proof of insurance. At any time, the Department of Revenue may also ask you to prove you have insurance.

If you are conducting legal research concerning auto insurance; Missouri Financial Responsibility Law can be found under Chapter 303 of the revised statutes. Title 20 of the Missouri Code of State Regulations contains the regulations regarding insurance.

Suspension/Reinstatement for Failure to Maintain Insurance

Statutory references: Sections 303.042 through 303.044, RSMo.

If your driving privilege and/or license plates are suspended for not having insurance, the following suspension periods will apply:

- 1st suspension = 0 days

- 2nd suspension in two years = 90 days

- 3rd and subsequent suspension = 1 year

After you serve the period of suspension, your driver license and/or license plates can be reinstated if the Driver License Bureau receives the following:

1st suspension

- Proof of insurance

- $20 reinstatement fee

2nd suspension

- Proof of insurance

- $200 reinstatement fee

3rd and subsequent suspension

- Proof of insurance

- $400 reinstatement fee

Proof of insurance must be maintained and filed with the Department of Revenue for a period of three years following the end of the suspension. If you fail to maintain proof of insurance, the Driver License Bureau will again suspend your driver license and/or license plates. The suspension will remain in effect for the remainder of the three years unless you refile proof of insurance and pay a $20 reinstatement fee.

NOTE: If an accident is involved, an SR-22 filing is required for proof of liability insurance. An identification card is not acceptable.

Notice of Suspension

Statutory reference: Section 303.041, RSMo.

If the Director of Revenue determines that the operator or owner of a motor vehicle involved in an accident has not maintained liability insurance, the operator or owner, or both, will be mailed a Notice of Suspension. The notice will include the reason for the suspension, the effective date of suspension, and the procedure to request a hearing.

Suspension for Failure to Maintain Insurance – Accident Involved

Statutory references: Section 303.042 through 303.044, RSMo.

If your driving privilege and/or license plates are suspended for not having insurance and an accident was involved, the following suspension periods will apply:

- 1st suspension = 0 days

- 2nd suspension = 90 days

- 3rd suspension = 1 year

After the driver and/or owner serves the period of suspension, his or her driver license/license plates can be reinstated if the Driver License Bureau receives the following:

1st suspension

- Proof of liability insurance. The most commonly used proof of insurance is an SR-22 filing. It must be kept for three years from the date you are eligible to reinstate.

- $20 reinstatement fee. Money order or personal check is acceptable. Please include your full name, date of birth, and driver license number.

2nd suspension

- Proof of liability insurance. The most commonly used proof of insurance is an SR-22 filing. It must be kept for three years from the date you are eligible to reinstate.

- $200 reinstatement fee. Money order or personal check is acceptable. Please include your full name, date of birth, and driver license number.

3rd or subsequent suspension

- Proof of liability insurance. The most commonly used proof of insurance is an SR-22 filing. It must be kept for three years from the date you are eligible to reinstate.

- $400 reinstatement fee. Money order or personal check is acceptable. Please include your full name, date of birth, and driver license number.

Suspension for Failure to Pay for Damages for Which You are Liable

Statutory references: Sections 303.030 and 303.042, RSMo.

If you are at fault for the accident and do not pay for the damages, your driver license and/or license plates will be suspended for one year. Your driver license and/or license plates can be reinstated within the one-year period provided you pay a $20 reinstatement fee and send proof to the Driver License Bureau that you have settled the accident loss.

Mail to:

Driver License Bureau301 West High Street – Room 470

Post Office Box 200

Jefferson City MO 65105-0200

Request for Hearing

Statutory reference: Section 303.290, RSMo.

If a hearing request is received before the suspension begins, the suspension(s) will be placed on hold until a final order is issued following a hearing. Mail your request to:

Administrative Hearing Section301 West High Street – Room 470

Post Office Box 3500

Jefferson City MO 65105-3500

Auto insurance requirements vary from state to state, but liability coverage is mandatory in most states. You may choose to opt out of certain types of coverage, depending on your budget and car’s age. Check with your state insurance regulator to learn more about its requirements and to research potential insurers.

See related post: